Lower than a decade in the past, Yongcheng Coal and Electrical energy Holding was one among China’s most celebrated power firms.

Blessed with ample reserves of high-grade coal at its mines in China’s central Henan province, the nation’s government-controlled banks had been keen handy the agency low-cost credit score. At its top in 2013, the enterprise’s annual income was Rmb127.4bn ($19.5bn).

“We had been essentially the most worthwhile coal mine with the very best salaries within the nation,” stated one senior Yongcheng govt, who requested to not be recognized, of that interval.

A dramatic decline has modified all that. The town of Yongcheng, the place the group relies, is in the present day pockmarked with half-built and dilapidated buildings. Struggling staff on the firm, a lot of whom haven’t been paid for months, have taken to packing and promoting flour to make ends meet.

However Yongcheng’s woes didn’t tackle nationwide significance till final month, when the corporate defaulted on bonds value Rmb3bn.

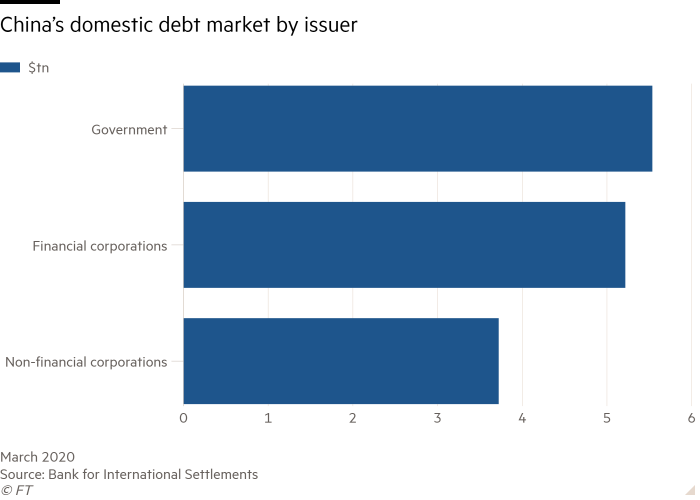

That growth disturbed China’s $15tn public debt market, the world’s second-biggest, and kicked off a spate of defaults at different native government-controlled companies, which account for a giant chunk of the nation’s economic system.

The defaults have ricocheted by way of China’s monetary system. Analysts say that state-linked firms now face difficulties elevating capital consequently. The episode has additionally obliterated longstanding investor assumptions that authorities will all the time bail out state-owned enterprises in China.

“The largest influence has been on different state-owned issuers,” stated Chen Lengthy at Plenum, a Beijing-based consultancy. “SOEs from Henan haven’t been capable of challenge any bonds in the previous few weeks. The longer that their firms will not be capable of challenge bonds, the larger the issue will develop.”

Some suppose that Yongcheng’s difficulties might be a harbinger for issues at different state-linked teams throughout China. “Yongcheng’s enterprise failure may occur to any state-owned enterprise with weak fundamentals,” added a Beijing-based investor that purchased the corporate’s bonds. “Much more defaults might be within the pipeline.”

Within the case of Yongcheng, the group’s downfall was sown by the monetary unravelling of its father or mother firm, Henan Power and Chemical Group. HECG pressured the coal miner to challenge more and more pricier bonds and borrow from China’s much less regulated shadow financial institution sector at a time when the general credit score surroundings was tightening.

That remodeled Yongcheng from what its bankers thought to be a low-risk borrower right into a a lot riskier proposition with a myriad of collectors.

The woes for Yongcheng and its father or mother will be traced again to greater than a decade in the past when the latter launched an ill-fated enlargement into coal-derived chemical compounds.

The enterprise earned HECG a spot on 2011’s Fortune 500 checklist of the world’s largest firms, prompting the Henan provincial authorities to name a press convention to rejoice the milestone.

HECG aimed to turn out to be “a world class coal firm”, Chen Xiang’en, the group’s president on the time, stated of its pivot to high-end chemical merchandise, which might finally trigger heavy losses for the corporate.

Costs of ethylene glycol, one among HECG’s largest chemical merchandise, have fallen by nearly two-thirds because the group started manufacturing it in 2011 due to a provide glut, with little respite on the horizon. “China’s coal chemical business is going through an oversupply that might take a few years to ease,” stated Qi Dan, an analyst at Baiinfo, a consultancy.

Twice weekly publication

Power is the world’s indispensable enterprise and Power Supply is its publication. Each Tuesday and Thursday, direct to your inbox, Power Supply brings you important information, forward-thinking evaluation and insider intelligence. Sign up here.

As its troubles within the chemical market deepened, HECG struggled to service its financial institution loans. Consequently, it turned to China’s nascent bond market, the place it has raised Rmb60bn ($9.1bn) over the previous 5 years, in response to public data.

“We paid a value for increasing our footprint with out bearing in mind profitability,” stated one senior supervisor at HECG.

In an try and shore up its funds, HECG started urgent Yongcheng, its best-performing subsidiary, to faucet bond markets. Yongcheng has raised Rmb66bn in debt since 2018, sometimes paying buyers curiosity of about 6 per cent.

However Yongcheng additionally turned to costlier belief loans — off-balance sheet lending by banks and different monetary establishments — with rates of interest ranging between 6.5 and seven.5 per cent. In response to folks instantly conversant in Yongcheng’s fundraising actions, a good portion of its bond and belief mortgage proceeds had been used to repay HECG’s money owed.

Yongcheng was not forthcoming with its buyers about this, typically telling them that it was elevating money to replenish working capital or pay down its personal debt. China’s Nationwide Affiliation of Monetary Market Institutional Traders, a regulatory physique, final month accused 4 of Yongcheng’s bond underwriters, its auditor, a ranking company and HECG of breaking capital market guidelines. Yongcheng and HECG declined to remark.

Some Yongcheng collectors say they knew the miner was propping up HECG, however assumed Henan’s provincial authorities would stand behind each firms due to their strategic significance to the native economic system, which thrives on exports of coal and flour. However they didn’t anticipate the Covid-19 pandemic, which has slammed many regional governments’ funds.

“We knew HECG was dragging Yongcheng down,” stated one investor. “However HECG is the largest SOE in Henan and the provincial authorities can’t afford to let it go beneath.”

Hopes of a full bailout from Henan are fading because the provincial authorities struggles with its personal rising fiscal deficit.

Two Yongcheng bondholders advised the Monetary Instances that HECG assured them early in November that the native authorities would inject Rmb15bn into the group to resolve its debt drawback. However lower than half of that sum has arrived, in response to folks with direct data of the state of affairs. “We maintained religion in authorities backing till the final second” earlier than the default, one of many buyers stated.

Since Yongcheng’s default, greater than 260 SOEs have suspended bond points. Those who have gone forward are having to pay higher interest rates.

“Now that authorities ensures are gone, underperforming SOEs should pay increased curiosity or they gained’t acquire entry to the credit score markets,” stated the top of credit score rankings at a Beijing-based bond investor.

For a lot of staff who’re enduring hardship because of the corporate’s difficulties, Yongcheng’s fall has been a humbling expertise.

“Ten years in the past I may earn Rmb12,000 a month when my associates at different firms made lower than Rmb2,000,” stated one Yongcheng engineer who has been with the corporate for 15 years, however has not been paid for six months.

He’s now promoting flour to maintain a dwelling. “Now I have to stay and not using a wage for half a yr and there’s no replace on when my subsequent pay cheque will arrive.”